tax sheltered annuity limits 2021

Web NSHE Tax Sheltered Annuities 403b Plan Regular Contribution Limits 50 Catch-Up Additional Contribution Limits. But this will increase to 20500 in 2022 matching the contribution limits of 401k plans.

The Tax Sheltered Annuity Tsa 403b Calculator

Web A tax-sheltered annuity plan or TSA annuity plan is a type of retirement plan offered by some public schools other government employers and nonprofits.

. Web Whats New for 2021. Web An example of a tax-sheltered annuity is the 403b plan in the US. Web 403b Contribution Limits by Year.

Web For State Employees Civil Service Board. Diversity Equity. When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered.

Web For the tax year 2021 the IRS will limit contributions to TSAs to 19500. If you are age 50 or older in. Diversity Equity.

Web If both the age 50 and the 15-year catch-up provisions are available any contributions that exceed the 20500 annual limit for 2022 or 19500 for 2021 will first. For 2021 the adjusted gross income limitations have increased from 65000 to 66000 for married filing jointly. Retirement savings contributions credit.

Year Elective Salary Deferral Limit Catch-up Contributions if Age 50 or Older Total Possible Employee Contribution Limit Total. The maximum contribution amount for the 2021 tax year was. Web The IRS recently announced the 2021 contribution limits for the UW Tax-Sheltered Annuity TSA 403 b Program and the Wisconsin Deferred Compensation WDC 457 Program.

Web The Internal Revenue Service IRS announced yesterday October 26 2020 the following dollar limits applicable to tax-qualified plans for 2021. 1 The Internal Revenue Service IRS. Web The IRS sets tax code limits on how much employees can contribute to their 403 b plan annually.

Web IRS Announces Year 2022 Retirement Plan Limits. Web The terms tax-sheltered annuity and 403b are often used interchangeably. Employee Benefits Executive Compensation November 5 2021 No.

Web For 2021 the most you can contribute to your TDA is 195003 However depending on your age and your years of service your maximum may be higher. The limit on the. Web For State Employees Civil Service Board.

Employees of specific nonprofit or public organizations may participate in this plan to.

Tax Planning For Retirement Ameriprise Financial

![]()

What Is A 403 B Is A Tax Sheltered Annuity A Good Idea

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

2021 Retirement Plan Contribution Limits

Irs Announces Higher 2022 Retirement Account Contribution Limits For 401 K S Not Iras

Tax Sheltered Annuity A Term That Should Die Educator Fi

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

403 B Plan Versus 401 K Plan Fairlight Advisors Llc

Learn About Retirement Income And Annuity Tax H R Block

What Tax Deferred Annuities Are And How They Work

Sec 403 B Retirement Plans A Comparison With 401 K Plans

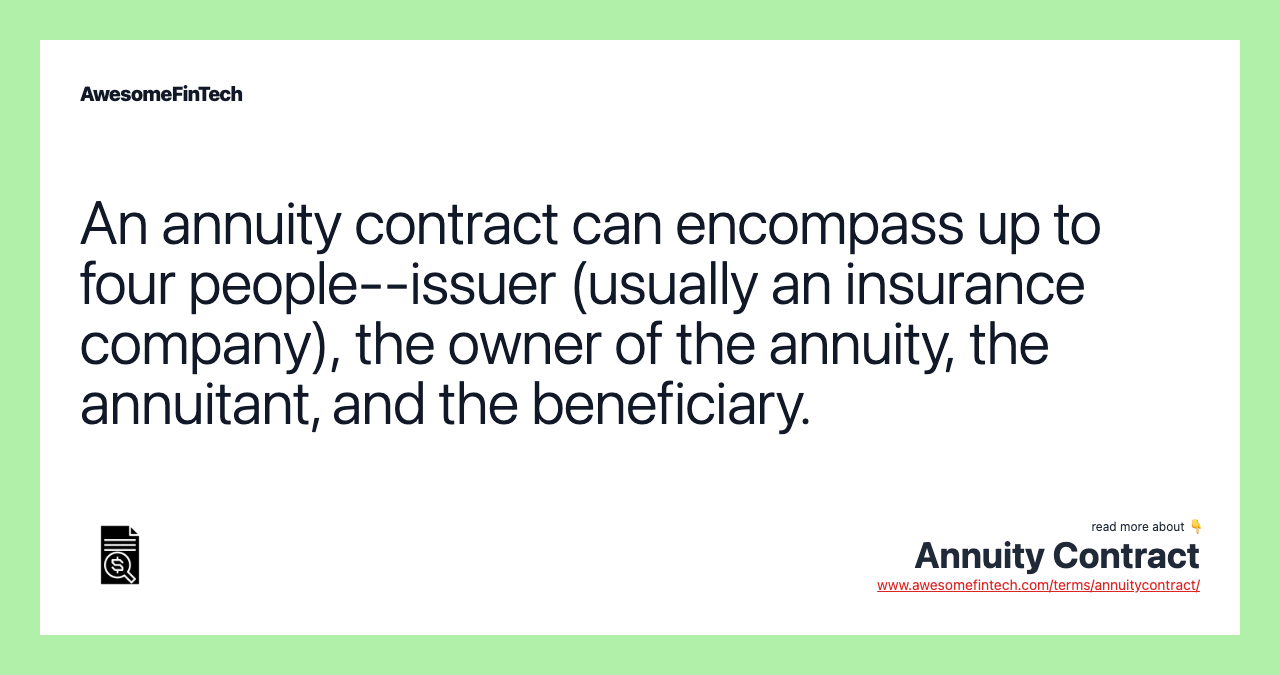

Irs Publication 571 Tax Sheltered Annuity Plans 403 B Plans Awesomefintech Blog

403 B Tax Sheltered Annuity Plans Renton School District 403

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What Are Tax Sheltered Investments Types Risks Benefits

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

2021 2022 Utsaver Retirement Plans The Best Value By Ut System Office Of Employee Benefits Issuu

:max_bytes(150000):strip_icc()/Safe-Retirement-Withdrawal-Rate-57a521625f9b58974aa2b94a.jpg)