is idaho tax friendly to retirees

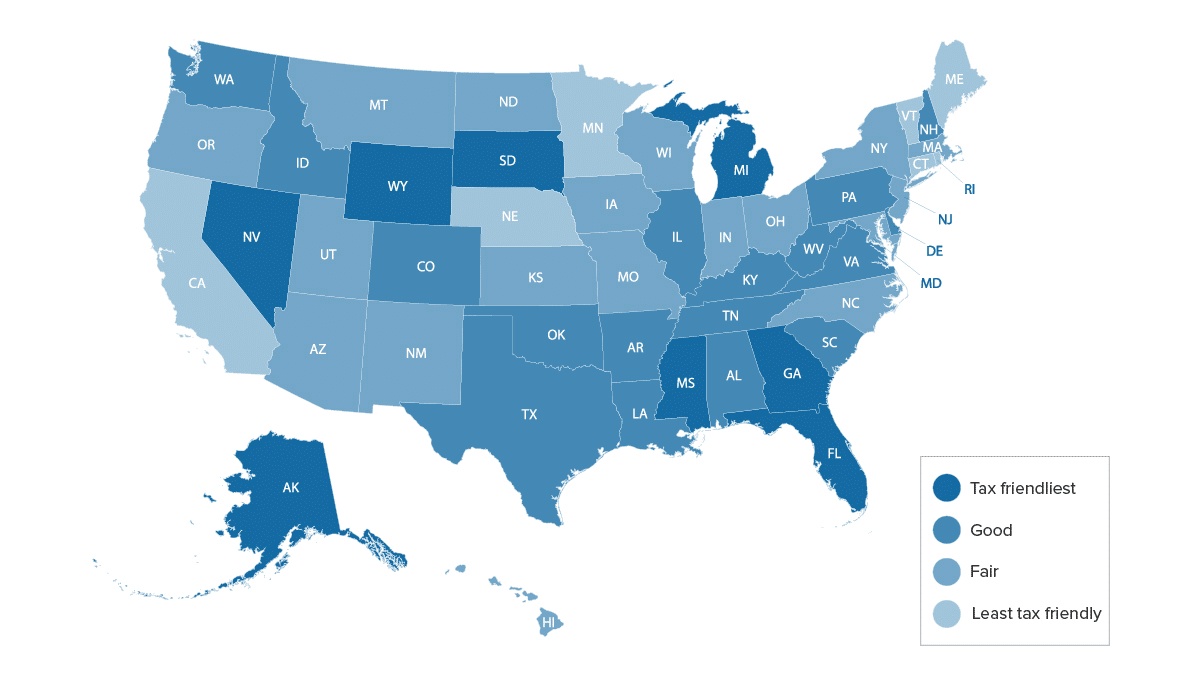

Income Tax Military pay is tax free if stationed out-of-state. Wyoming may be the most tax-friendly state south of Alaska.

Idaho Retirement Tax Friendliness Smartasset

Localities can add as much as 56 to that but the average combined levy is 84 according to the Tax Foundation.

. There are a number of sales tax exemptions and reductions in Utah that should help retirees reduce their overall sales tax bill. Also check out the tax-specific slideshows listed below the map including our picks for the 10 most tax-friendly and the 10 least tax-friendly states in the US. While the overall cost of living in Leesburg is lower than the state average the sales tax.

Idahos sales tax is the highest among our top 10. Including the base sales tax rate of 610 and local rates that average about 108 the total average rate in Utah is 719. Retirement benefits and Social Security income are not taxed and Florida residents 65 and older who meet certain requirements receive a tax break on property taxes.

Each state has a different mix of tax breaks for retireesmost exempt certain types of retirement income but they tax others. Many California companies have relocated to Idaho strengthening the economy. The state and average local sales tax rate is 539.

Alabama is considered a tax-friendly state for retirees according to Kiplinger. This means that most senior benefits including Social Security and pension funds are not taxed by the state. Overall Rating for Taxes on Retirees.

Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees. Affordabilityincludes adjusted cost of living taxes taxation on retirement income property and purchases estate tax plus tax breaks for seniors cost of in-home health care and adult day. Groceries are taxed at.

Thirty states exempt all Social Security benefits from taxation. The Louisiana LA state sales tax rate is currently 445. Many retirees move to another city to fulfill their dreams of living in a different.

Nine states include Social Security benefits in taxable income but they provide exclusions exemptions and deductions. Same as retired pay. Idaho State Tax.

The average effective property tax rate in Wyoming is just 057. Though sales taxes can be steep due to local parish and jurisdiction sales taxes food and medications are exempt from sales. It does not have its own income tax which means all forms of retirement income will not be taxed at the state level.

Seniors get an additional 20. Military retirement and SBP recipients can deduct up to 37776 of their retirementSBP income for a single filer or 56664 for a. Tax free for for retirees over 65 disabled retirees over 62.

Alabama doesnt have an estate or inheritance tax either. Depending on local municipalities the total tax rate can be as high as 1145. In addition homeowners who are over 65 do not have to pay property taxes to the state.

Is Wyoming tax-friendly for retirees. While food is taxed at the 6 percent sales tax rate the state provides a 110 per person credit. Idaho ranks 15th-lowest in property taxes at 075 percent and has a state income tax of up to 693 percent.

New Yorks top state tax rate is 882 as of 2022 but then youll have to add another 3867 for the local tax if you live in New York City. The Worst States for Lottery Taxes New Jersey comes in as the worst state for lottery taxes with. People retire to Idaho for safety family values friendly communities and miles of protected lands filled with natural beauty.

Railroad Retirement benefits are not taxed. Tax-free if stationed out-of-state.

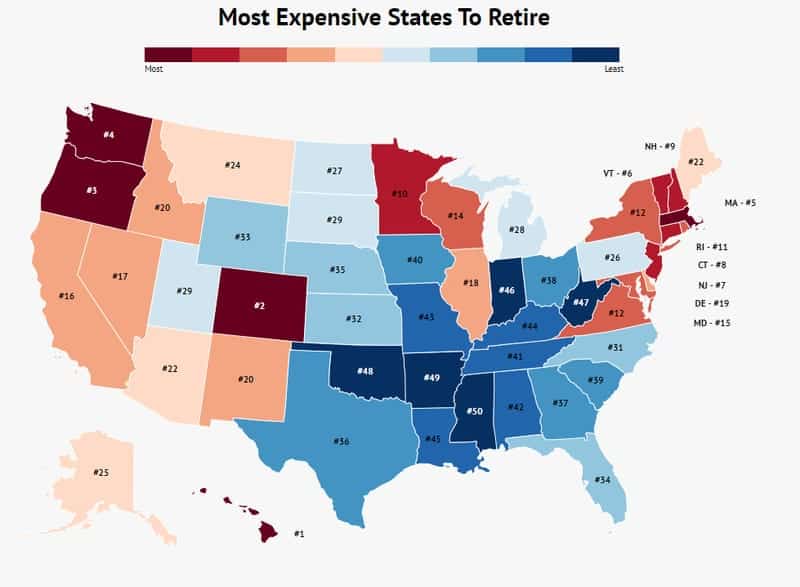

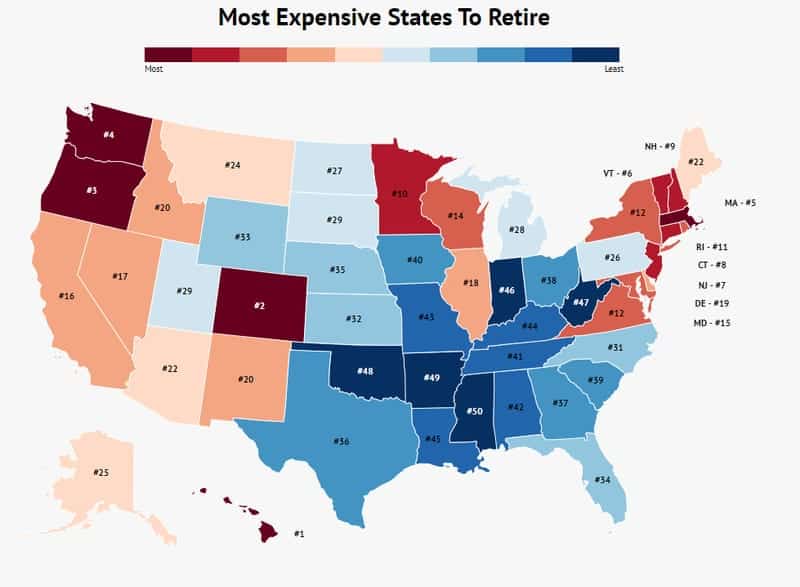

Most Tax Friendly States For Retirees Ranked Goodlife

State By State Guide To Taxes On Retirees Retirement Strategies Tax Retirement Income

Don T Retire In These 10 States If You Want To Keep Your Money The Most Expensive States To Retire Zippia

Idaho Retirement Taxes And Economic Factors To Consider

Great College Towns To Retire To Kiplinger Sunrise Photography College Town Before Sunrise

4 Best Places To Retire In Idaho On A Budget

Idaho Retirement Tax Friendliness Smartasset

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Iconic Idaho Idaho At Play Volume I Idaho Best Places To Retire Natural Landmarks

West Virginia Is Third Best State For Retirement Survey Says Wowk 13 News

Top 5 Places To Retire In Idaho New Cyber Senior

Idaho Retirement Tax Friendliness Smartasset

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

Some States Are Lowering Taxes To Entice Retirees To Relocate Legacy Planning Law Group

Map Here Are The Best And Worst U S States For Retirement In 2020

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Idaho Retirement Guide Idaho Best Places To Retire Top Retirements